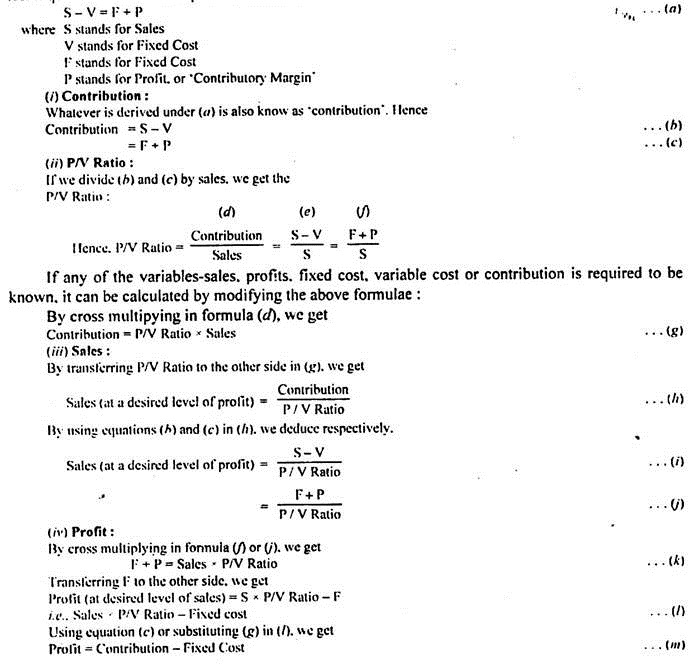

The additional $5 per unit in the variable cost lowers the contribution margin ratio 20%. Each of these three examples could be illustrated with a change in the opposite direction. A decrease in sales quantity would not impact the contribution margin ratio. A decrease in unit selling price would also decrease this ratio, and a decrease in unit variable cost would increase it. Any change in fixed costs, although not illustrated in the examples, would not affect the contribution margin ratio. Cost Volume Profit analysis helps in determining the level at which all relevant cost is recovered, and there is no profit or loss, which is also called the breakeven point.

Continually monitor and update CVP analysis – Best Practices for Cost-Volume-Profit (CVP) Analysis

- This information is crucial as it can show business owners the minimum level of sales they must achieve to remain operational.

- Understanding the impact of changes in sales price is critical for businesses to make informed decisions that maximize profits.

- At one point, the company’s founder was so busy producing small pizzas he did not have time to determine that the company was losing money on them.

- The reality is, of course, that decisions such as staffing and food purchases have to be made on the basis of estimates, with these estimates being based on past experience.

The contribution margin is the amount left over after subtracting variable costs from the revenue. It represents the amount available from each unit of sale to cover fixed costs and generate profits. CVP analysis is a valuable tool for businesses to prepare budgets and forecasts. This analysis enables companies to project their future costs, profits, and sales volume accurately.

Frequently Asked Questions- Cost-Volume-Profit (CVP) Analysis

Finally, remember that the method assumes that all units made are going to be sold. Unfortunately, this is not something that can be guaranteed in reality and will depend on external factors, including supply, demand, and competitor strategies. The cost-volume-profit chart, often abbreviated, is a graphical representation of the cost-volume-profit analysis. Subtract the variable cost from the sale price ($5-the $3 in our sub example). Simply put, break-even analysis calculates how many sales it takes to pay for the cost of doing business to reach a break-even point (neither making nor losing money). One considerable limitation of CVP analysis lies in its heavy reliance on stringent assumptions.

A. Sales volume – The Components of Cost-Volume-Profit (CVP) Analysis

CVP analysis enables businesses to make informed pricing decisions for their goods and services. Companies can determine the most profitable price points to ensure optimal revenues and margins by analyzing sales volume, the cost of goods sold, and other related expenses. The break-even point is important because it gives businesses a clear understanding of the sales volume they need to achieve to cover their costs and profit. It can also help businesses to make informed decisions about pricing, product mix, and resource allocation. Variable costs are costs that vary with the level of production or sales.

In addition, the analysis often assumes a single product being sold or, in the case of multiple products, a constant mix. This keeps the focus strictly on the relationship between cost, volume, and profit without the added complexity of varying product offerings. At the core of cost volume profit analysis are a number of assumptions and principles which guides how analyses are typically conducted. Each one plays a crucial role in the calculation and interpretation of the analysis. With CVP Analysis information, the management can better understand the overall performance and determine what units it should sell to break even or to reach a certain level of profit. This information will likely be the basis for a reasonable forecast of future sales volume and determine the impact of cost changes on net profit.

Identifying Contribution Margin Point in Cost-Volume-Profit (CVP) Analysis

If only we could look into a crystal ball and find out exactly how many customers were going to buy our product, we would be able to make perfect business decisions and maximise profits. The formula to compute net operating income, sometimes referred to as net income or net profit, is the organization’s revenues less its expenses. Variable costs are the same cost per unit but the total cost depends on the quantity produced, educator expense deduction used, or sold. By comprehensively analyzing these elements, leaders can make data-driven decisions that steer the company toward improved financial outcomes and strategic growth initiatives. Quickly surface insights, drive strategic decisions, and help the business stay on track. You can analyze different scenarios to determine how much you would need to sell in order to break even or reach a certain profit margin.

You also know how to use Google Sheets to carry out your own CVP analysis. Performing this type of analysis usually requires data from multiple sources and the involvement of multiple people. A tool like Layer allows you to seamlessly connect your data and automate data flows to update your calculations.

Understanding the impact of changes in sales price is critical for businesses to make informed decisions that maximize profits. By analyzing the impact of different sales prices on contribution margin and profitability, businesses can determine the optimal price point for their products or services. In summary, fixed costs are costs that remain constant regardless of the volume of sales or production. Identifying fixed costs is important for understanding a company’s profitability and cash flow, making informed decisions, and budgeting and forecasting.