The rent of the apartment is $4000 per month, which he charges as an expense in the accounting records of his business. Rambo is of the view that since he owns the entire business himself, there is no harm in charging the full rent as a business expense. To apply this principle in practice, we need to think of each business as a separate entity that is distinct from its owners and other businesses. For example, if you loan money to your own company, that counts as one of your business’s liabilities because you would need to pay yourself back. Also, if you have a business credit card, make sure you don’t use a personal credit card for your business.

Ask a Financial Professional Any Question

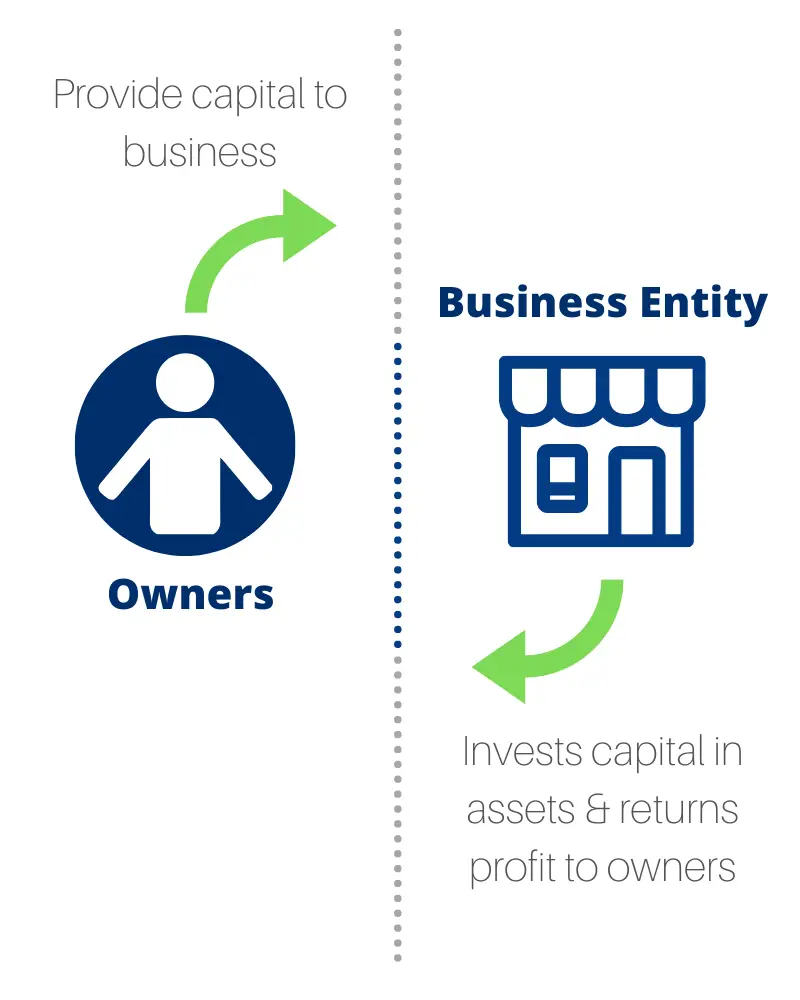

In other words, businesses, related businesses, and the owners should be accounted for separately. Even though the tax law looks at a sole proprietorship and the owner as one entity, GAAP disagrees. The owner and the business are two separate entities and should be accounted for separately. The partners and shareholders’ activities should be kept separate from the partnership and corporate transactions because they are separate economic entities. That means when money moves in or out of that business, those transactions should be kept in their own set of accounting records.

- Consideration should be given to the fact that excessive detail may not actually improve presentation and therefore not assist users of financial statements.

- This is a more advanced issue, which requires the exercise of professional judgment.

- The business entity concept is very important as it helps to measure the performance of a business separate from its owner and on different parameters such as cash flows, profitability, etc.

- For instance, if a sole proprietor is using house space for office work, it should be rented to the business at the market competitive rates.

Business Entity Principle

A corporation is a complex entity structure that can be owned by shareholders and managed by its directors. The directors may or may not include major shareholders of a corporation. Suppose Mr. A owns a vehicle that he uses for personal and business purposes in routine. All vehicle maintenance, gas, and lease expenses should be apportioned according to the mileage usage fairly. By ensuring that the key points of each of these principles and concepts are understood, candidates should be better prepared to answer questions that might arise in the exam.

Limited Liability Companies (LLCs)

For example, if one shareholder invests $20,000 into a corporation, he is personally not responsible for the corporation’s debt that exceeds $20,000. Partnerships are easy to create and dissolve, but it lacks business continuity. Upon the death of a partner, its assets become part of his estate or pass to heirs as per law. The Wix website builder offers a complete solution from enterprise-grade infrastructure and business features to advanced SEO and marketing tools–enabling anyone to create and grow online. The budget created for the company reflects the firm’s value, not the owner’s net worth.

Types of Business Entities

Additionally, department heads may opt to supervise specific business endeavors, and some employees and laborers carry out specific duties as required. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

The purpose of the concept is to ensure the business’ financial statements reflect the company’s performance. It allows shareholders and other stakeholders to determine its financial performance and positioning. A corporate shield is a legal form of protection, whereas the business entity concept applies to recordkeeping and accounting practices. The corporate veil shields the owners from liabilities about the business, like lawsuits. Legally, it’s important to understand this concept does not include basic partnerships or sole proprietorships. New business entities are formed by filing paperwork with your state, if required, and paying any required fees.

However, this structure lacks business continuity in case the owner dies or decides to retire from business. It helps in ascertaining the value of the assets and liabilities of a business in the event of any legal action taken against the business. Payment for things that are of personal use by the owner cannot be considered a business expense. Since the business is treated as a separate entity, the true net worth of the owner remains hidden. Maintaining this separation is crucial when comparing a company’s financial performance to others in the same industry. This management hierarchy may include roles such as the Chairman, Managing Directors, and Board of Directors.

The earliest known form of business entity was the partnership, which was prevalent in ancient civilizations such as Babylon and Egypt. Over time, different legal structures such as sole proprietorships, corporations, and limited liability companies (LLCs) emerged. Often, the owner of a single-member limited liability company or a sole proprietorship only needs to file a single tax return. Also, the IRS “disregards” those business entities because the owner only needs to report their personal income and deductions. When the business owner files their taxes, they will report their business expenses and income on a Schedule C form along with their personal Form 1040.

The U.S. Small Business Administration has local offices that can advise on setting up your business. The SBA also partners with vetted organizations that provide free or low-cost business advice, such as the Women’s Business Center. Consult with a lawyer or accountant to determine the most appropriate legal structure for your business.

This separation ensures that business transactions and financial records are accounted for separately from the owner’s personal assets and liabilities. This principle entails the exclusive use of accounting records dedicated to the specific organization, completely excluding any inclusion of assets or liabilities related to other entities or the proprietor. The business entity concept, also known as the economic entity assumption, states that all business entities should be accounted for separately.

The hierarchy of managers may range from Chairman, Managing Director, or member of the Board of Directors, overhead business right down to the sectional heads appointed to manage specific operations of the enterprise.